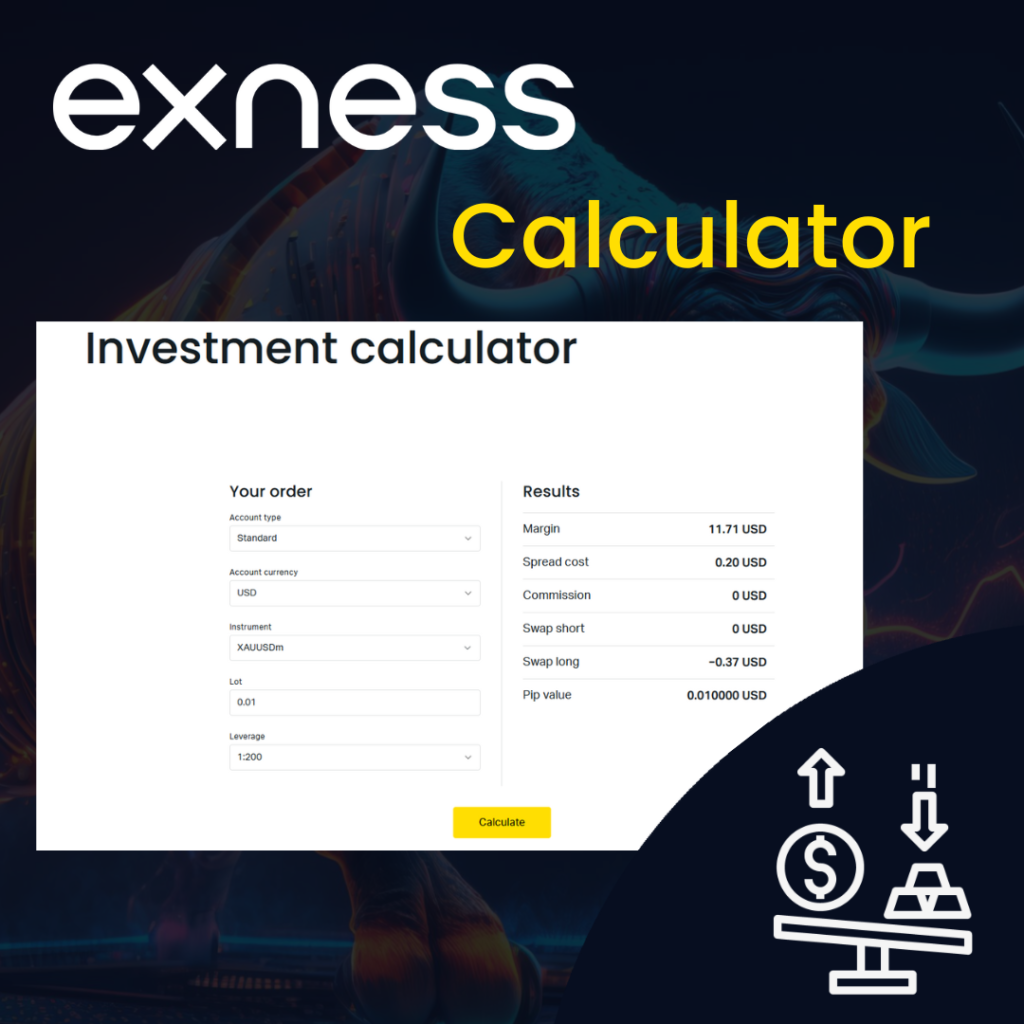

- What is the Exness Investment Calculator?

- Selecting Account Type and Trading Instrument

- Inputting Position Size, Entry Price, and Leverage

- Choosing Account Currency

- Understanding the Output from the Exness Investment Calculator

- Example of Using Exness Investment Calculator

- Key Features of the Exness Investment Calculator

- Integrating the Exness Investment Calculator into Your Investment Strategy

- Conclusion

- FAQ

What is the Exness Investment Calculator?

The Exness Investment Calculator is a tool designed to help users calculate potential profits or losses from investment decisions based on various parameters. This calculator allows traders and investors to determine possible returns based on such data as the investment amount, percentage yield, time period, and asset type. The main purpose of using the calculator is to predict the possible outcome of financial transactions while minimizing risks.

The calculator functionality allows the user to enter their data, such as initial capital, planned investment period, and expected return. The tool automatically calculates the result based on the entered data and displays the expected profit, which allows the user to assess the prospects of their investment strategy. Thus, the calculator becomes useful for planning and monitoring financial transactions in real time.

The Exness Investment Calculator is in demand among both beginners and experienced traders, as it helps to quickly assess the prospects of a transaction. This allows you to make more informed decisions and avoid unexpected losses. Using this tool increases the level of financial literacy, giving the opportunity to calculate possible investment development scenarios in advance.

Key Components of the Investment Calculator:

Profit Calculator: This component helps traders estimate potential profits or losses based on variables such as entry and exit prices, trade size, and currency pair.

- Usage: Enter buy and sell prices along with the trade amount to calculate potential outcomes, taking into account spreads and fees.

Forex Calculator: Essential for forex traders, this calculator aids in conversions and margin requirements.

- Usage: Input details like currency pair, trade size, and leverage to receive crucial financial metrics including required margin and pip value.

Leverage Calculator: Understand the impact of leverage on your trades, which can significantly amplify both gains and losses.

- Usage: Provide the capital amount, leverage ratio, and position value to determine total exposure and necessary margin.

Trading Calculator: A holistic tool that aggregates features of the profit, forex, and leverage calculators to offer a detailed financial overview of planned trades.

- Usage: Input instrument type, price levels, lot size, and leverage to acquire comprehensive info on margins, pip values, swap fees, and potential outcomes.

Advantages:

- Risk Management: Facilitates precise calculation of risk per trade, helping maintain exposure within safe limits.

- Strategy Planning: Supports detailed planning of trading parameters like entry and exit points, expected returns, and stop-loss orders.

- Financial Optimization: Enables effective use of leverage, balancing potential high returns against possible increased losses.

How to Access:

Access the Exness Investment Calculator directly from the Exness website under the tools or resources section. Simply log into your Exness account to use this feature, ensuring that all calculations are customized to your specific trading conditions and account settings.

The Exness Investment Calculator is an essential tool for both seasoned traders and newcomers, offering detailed financial insights and helping to manage trading portfolios more effectively. It’s recommended that traders complement the use of this calculator with personal analysis to make well-informed trading decisions.

Using the Exness Investment Calculator The Exness Investment Calculator is a crucial tool for traders aiming to analyze potential trades and refine their strategies. Here’s a detailed guide on how to utilize the calculator effectively, navigating through its various functions:

Selecting Account Type and Trading Instrument

1. Choose Account Type:

- Procedure: Start by selecting the type of trading account you hold with Exness, such as Standard, Pro, or ECN. This selection is vital as different account types offer varying conditions like spreads, leverage options, and commission rates, which impact the calculation results.

- Impact: Choosing the correct account type is essential as it influences the profitability and risk level of your trades based on specific account conditions.

2. Select Trading Instrument:

- Procedure: Choose the trading instrument you plan to trade, such as forex pairs, commodities, indices, or cryptocurrencies.

- Impact: Each instrument has unique characteristics like volatility and liquidity that are crucial for accurately calculating potential profits and effectively managing risks.

Inputting Position Size, Entry Price, and Leverage

1. Position Size:

- Procedure: Enter the size of your position, usually measured in lots or units, depending on the instrument. This size directly impacts both the potential return and the risk of the trade.

- Impact: Larger positions can increase both potential profit and risk. It’s vital to balance your position size within your overall risk management strategy.

2. Entry Price:

- Procedure: Input the entry price at which you anticipate entering the trade, based on your market analysis and trading strategy.

- Impact: The entry price is crucial for determining the initial cost of the trade and essential for calculating potential profit or loss based on your target and stop-loss levels.

3. Leverage:

- Procedure: Select the amount of leverage you want to apply to your trade. Leverage allows you to increase your exposure without a proportional increase in your capital investment.

- Impact: While leverage can enhance returns, it also increases risk. It’s important to judiciously use leverage, taking into account both its advantages and potential pitfalls.

Choosing Account Currency

Procedure

Choosing the right currency for your Exness trading account is perhaps one of the key points that can have a significant impact on your trading performance. Although it may seem like a simple detail at first glance, choosing the right currency will actually help you avoid unnecessary costs and simplify your capital management.

Let’s start with the fact that changing the account currency requires attention to detail. The first thing you need to do is log in to your personal account. This is like the front door to the world of your financial transactions, from where you get access to all the settings and account data. Once logged in, you need to find the section with your account settings, where you can choose one of the available currencies.

And here comes the important question: which currency to choose? The answer is simple – focus on the currency in which you most often conduct financial transactions. For example, if the bulk of your funds are already stored in dollars or euros, it makes sense to choose this currency. This will not only save you from having to convert money from one currency to another, but will also help you avoid possible fees that may arise with each transaction.

It is also important to remember that choosing the right currency directly affects your financial management convenience. Fewer conversions means fewer headaches and surprises in the form of additional fees. Ultimately, this step helps optimize not only your trading process, but also your overall financial strategy. Agree, it is nice to know that your funds remain under complete control and that you are not losing them on unnecessary commissions and fees.

Understanding the Output from the Exness Investment Calculator

To effectively manage your investments and minimize risks, it is essential to fully understand how the Exness Investment Calculator works. This tool is more than just a set of numbers – it helps you analyze current financial conditions and predict potential returns, allowing you to build more thoughtful and accurate strategies. Understanding how it works and the factors that influence the calculation results gives you the opportunity to more objectively assess your financial situation and make informed decisions. This knowledge serves as the basis for creating a stable and successful investment portfolio that can withstand both short-term fluctuations and long-term changes in the market.

However, to achieve maximum accuracy and efficiency, it is important not only to understand how the calculator generates numbers, but also to consider the broader context. Results can be influenced by a variety of factors: market volatility, changes in exchange rates, economic events, and even the psychology of market participants. This multi-factor analysis allows you to better understand why specific calculator calculations may change and helps you adjust your strategy in a timely manner depending on current market conditions. For example, you may find that during periods of high volatility, the calculator’s results require more careful interpretation and additional adjustments.

It is important to remember that an investment calculator is just one of many tools that can and should be used for analysis and planning. It is not a panacea and cannot replace your own experience and intuition. Its data is always better supported by information from other sources, such as analytical reports, economists’ forecasts, market trends and even your personal understanding of the situation. In this way, you will be able to develop a more holistic approach to investment management that will help minimize potential errors and improve the effectiveness of your financial decisions.

Ultimately, understanding how a calculator works is not just a step towards improving your investment strategy. It is a critical element in creating a long-term, reliable and successful financial plan that will serve you in any situation.

Margin Requirements and Leverage Impact

Margin Requirements:

- Explanation: This is the capital needed to open and maintain a position, determined by the selected leverage and the total value of the position.

- Interpretation: Higher leverage allows for larger positions with less capital by reducing the margin requirement. However, this also heightens risk by magnifying potential gains and losses. Understanding the balance between leverage and margin requirement is crucial for effective risk management.

Spread Cost and Commissions

Spread Cost:

- Explanation: Represented as the difference between the bid and ask prices, the spread is essentially the cost incurred each time a trade is opened.

- Interpretation: The calculator displays the cost of the spread based on your position size. Favorable strategies, especially those involving frequent trades like scalping, benefit from lower spreads as they reduce transaction costs.

Commissions:

- Explanation: Depending on the account type or specific instruments, a commission may be charged per trade by the broker.

- Interpretation: It’s essential to be aware of commission structures since they directly affect the total trading cost. For traders who execute large volumes, high commissions can significantly impact profitability.

Swaps and Position Holding Costs

Swaps:

- Explanation: These are fees or overnight interest charges applied when a position is held open beyond the daily closing time. Swap rates vary based on the interest rate differential between the currencies involved in the trade.

- Interpretation: The calculator estimates swap costs using current rates, which is important for traders planning to hold positions overnight or longer, influencing overall trade profitability.

Pip Value for the Selected Instrument

Pip Value:

- Explanation: This reflects the financial impact of a one-pip movement in the exchange rate on the position’s value.

- Interpretation: Knowing the pip value is crucial for calculating potential profits or losses from market movements. It aids in setting precise risk management tools like stop-loss orders, which are essential for safeguarding investments. The pip value can vary based on the currency pair, trade size, and the account’s currency.

By thoroughly understanding how to interpret these crucial outputs from the Exness Investment Calculator—ranging from leverage effects and trading costs to pip values and swaps—traders can enhance their ability to manage risks and devise effective trading strategies. This understanding is fundamental to navigating the complexities of forex markets and achieving sustained trading success.

Example of Using Exness Investment Calculator

To really grasp how the Exness Investment Calculator works, it’s helpful to dive into practical examples. While the theory and basic principles offer a general understanding, it’s through real-world scenarios that the calculator’s true functionality becomes clearer. These examples show how different factors—like the investment amount, expected return, and time frame—shape the final outcome. This gives users a concrete sense of how profit forecasts shift based on the parameters they choose, enabling them to make more informed decisions.

Seeing real-life examples also highlights the calculator’s strengths and limitations. By using the tool hands-on, users can pick up on crucial details they might otherwise overlook—details that could significantly influence their investment choices. Examples bridge the gap between theory and practice, helping users avoid mistakes or misunderstandings. They also reveal potential risks and opportunities that may not be immediately obvious, giving a more accurate picture of how valuable the calculator can be for managing investments.

Scenario:

A trader wants to estimate potential profits and calculate the required margin for a trade on the EUR/USD pair.

- Account Type: Standard

- Trading Instrument: EUR/USD

- Account Currency: USD

- Position Size: 1 lot (100,000 units)

- Entry Price: 1.1800

- Exit Price: 1.1850

- Leverage: 1:100

Steps to Use the Calculator:

- Select the Account Type: Choose ‘Standard’ from the dropdown menu. This choice affects spread and leverage options.

- Input Trading Instrument: Select ‘EUR/USD’ from the list. This step is critical as different instruments can have different spreads and margin requirements.

- Set the Account Currency: Confirm that ‘USD’ is selected, ensuring that all financial calculations are displayed in the trader’s account currency.

- Enter the Position Size: Input ‘1 lot’, which is equivalent to 100,000 units of the base currency. Position size is pivotal for calculating the margin required and potential profits.

- Provide Entry and Exit Prices: Enter ‘1.1800’ for the entry price and ‘1.1850’ for the exit price. This difference will determine the profit or loss from the trade.

- Choose Leverage: Select ‘1:100’ from the leverage options. Leverage affects the amount of margin required to open and maintain the position.

Results Interpretation:

Profit/Loss Calculation:

- The calculator will automatically compute the profit or loss based on the entry and exit prices. In this scenario, the trade results in a profit from the 50 pip movement in the EUR/USD pair.

Required Margin:

- With the leverage set at 1:100, the calculator shows how much capital (margin) is needed to open the trade. Lower leverage means a higher required margin.

Pip Value:

- The calculator also provides the value of each pip movement. Understanding the pip value is crucial for this trade as it determines the monetary gain from the 50 pip increase.

This example demonstrates the practical use of the Exness Investment Calculator to strategically plan a trade, assessing potential returns and understanding the financial implications of trade settings. It’s an invaluable tool for traders to maximize their efficacy and manage risk more effectively.

Key Features of the Exness Investment Calculator

Traders choose the Exness investment calculator for many reasons, and one of the key ones is its high efficiency in planning and analyzing trades. This tool not only helps a trader see the possible results of his strategy, but also provides a deep understanding of various aspects of trading. Imagine that you can, depending on many factors, such as the type of asset, investment volume, leverage or even the duration of holding a position, literally “calculate” your steps several moves ahead. It’s like a game of chess, where every mistake can cost you dearly, but with such a tool, the probability of miscalculation is significantly reduced.

What makes Exness truly unique is the convenience and ease of use of the calculator. You can be a beginner who is just starting to master the market, or a professional who has been trading for years, but the intuitive interface and multifunctionality of the calculator make it useful for everyone. There is no need to figure it out for a long time – you enter data such as currency pairs, the size of the transaction, select the required leverage, and in a few seconds you see the expected result. This is not just a calculation – it is real help in understanding what you can get from each transaction.

It is important to note that the calculator takes into account current market conditions, which makes the calculations as accurate and relevant as possible. After all, the world of finance is always dynamic, where every change can significantly affect the outcome. With Exness, a trader gets the opportunity to be one step ahead, anticipate possible scenarios and adapt to changes.

Another plus is that Exness offers not one, but several calculators that can help calculate different aspects of a transaction. For example, profit, margin, swap and leverage calculators allow you to comprehensively approach the assessment of risks and benefits. It is like a tool in the hands of a master: the more options you have, the more chances you have to do everything perfectly.

Understanding Potential Profits and Risks

- Profit Calculations: The calculator enables traders to input hypothetical entry and exit points for trades to project potential profits or losses. This functionality is crucial for setting realistic profit targets and planning trades strategically.

- Risk Assessment: It also computes the required margin based on the leverage selected, offering insights into the capital at risk. This feature aids traders in managing their trading capital more efficiently and making informed decisions based on their risk tolerance.

Customizable Investment Scenarios

- Versatility in Parameters: Traders can adjust various factors such as leverage, position size, and set specific stop-loss and take-profit levels to see how these changes affect potential outcomes.

- Scenario Analysis: This feature allows traders to simulate different market conditions and test “what-if” scenarios without financial risk. It helps traders optimize their strategies by providing a platform to experiment with various trading setups.

Key Advantages Over Traditional Methods

- Speed and Efficiency: The Exness Calculator provides immediate calculations for profit, loss, margin requirements, and more, which is much faster and more efficient than manual calculations typically done via spreadsheets or basic financial calculators.

- Accuracy: Automatic adjustments for current market conditions, exact leverage settings, and precise instrument specifications reduce the likelihood of errors and ensure high accuracy.

- Accessibility: Available directly through the web without any need for downloads, the calculator can be accessed from anywhere, providing convenience and flexibility.

- Comprehensive Analysis: Unlike traditional methods that may require separate tools to assess different aspects, the Exness calculator integrates various financial calculations into one tool, providing a holistic overview of potential trade outcomes.

Integrating the Exness Investment Calculator into Your Investment Strategy

Integrating the Exness trading calculator into your trading strategy can be an important step towards increasing efficiency and profitability in the financial markets. This tool helps traders accurately calculate key parameters of trades, which not only reduces risks but also increases potential profits. In order to get the maximum benefit, it is extremely important to carefully study the instructions for using the calculator, as its incorrect settings can negatively affect the results.

Often, novice traders make the mistake of ignoring the details in the instructions, which leads to incorrect calculations. For the calculator to work accurately, it is necessary to understand how individual parameters function and how they can affect the final results of the transaction, be it profit or loss.

The user manual for the Exness trading calculator contains all the necessary steps for its correct setup and use. It explains in detail key points such as the choice of a trading instrument, taking into account leverage, as well as the calculation of possible commissions and swaps. In addition, it is important to correctly determine the lot size, as these factors directly affect the outcome of the transaction. A thorough study of all these aspects will help you avoid mistakes and improve your trading results.

1. Pre-Trade Analysis

Utilize the calculator to evaluate potential profits and risks before executing a trade. By inputting various scenarios, you can gauge how changes in market price, leverage, or position size might impact outcomes. This insight is invaluable for setting precise entry and exit points, as well as appropriate stop-loss and take-profit orders.

2. Risk Management

Consistently use the calculator to determine suitable amounts of leverage and margin for your trades to ensure you are not overexposed in any single position. This practice is fundamental in maintaining sound risk management principles and safeguarding your capital.

3. Performance Review

After completing trades, employ the calculator to compare expected results with actual outcomes. This review can provide critical insights into the accuracy of your market predictions and the overall effectiveness of your trading strategy.

4. Strategic Adjustments

Based on insights gleaned from the calculator, make necessary adjustments to your trading strategies and parameters. For instance, if you notice that your risk levels are consistently too high, consider reducing your leverage or decreasing your position sizes.

5. Educational Tool

For novice traders, the calculator serves as an educational resource to better understand the financial mechanics of trading. It helps elucidate how different factors like price changes, leverage, and market conditions interact to influence trade profitability.

Conclusion

The Exness Investment Calculator is an advanced tool that offers marked advantages over traditional methods, including enhanced speed, efficiency, accuracy, and accessibility. By integrating this calculator into your trading strategy, you can make more informed decisions, effectively manage risks, and potentially improve your overall trading performance. This tool not only facilitates operational efficiencies but also fosters strategic trading growth and deepens financial understanding.

Frequently Asked Questions

What is the best leverage for a $10 account on Exness?

For a $10 account on Exness, it’s prudent to use lower leverage to minimize risk, particularly if you are a beginner. Although Exness offers leverage up to 1:2000, using more conservative levels like 1:100 or 1:200 may help manage risk more effectively.